Your go-to resource for Competitor Analysis in Autonomous Vehicles

This report examines the leaders and followers in the ADAS and Autonomous Driving race, from carmakers to suppliers and emerging start-ups, to help you discover big opportunities for new revenue pools as competition intensifies.

Competition in ADAS and Autonomous Vehicles is fierce as vehicle manufacturers, automotive component suppliers, and new entrants strive to:

- monetize the rising sensor content in vehicles, e.g. radars, cameras, and lidar to support higher levels of automation;

- respond to the need for data processing and computing to support new cruising and parking features;

- democratise software-defined vehicles to keep them up-to-date and secure.

- take advantage of changing regulations to capture new markets and customers

8 Reasons You Should Read This Report: Our Unique Value Proposition

This report analyses the strategies, technologies and market potential of AI in Automotive to provide competitor insights and actionable guidance.

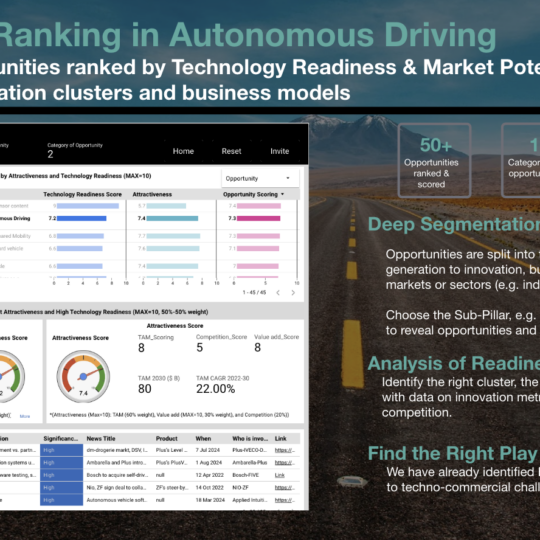

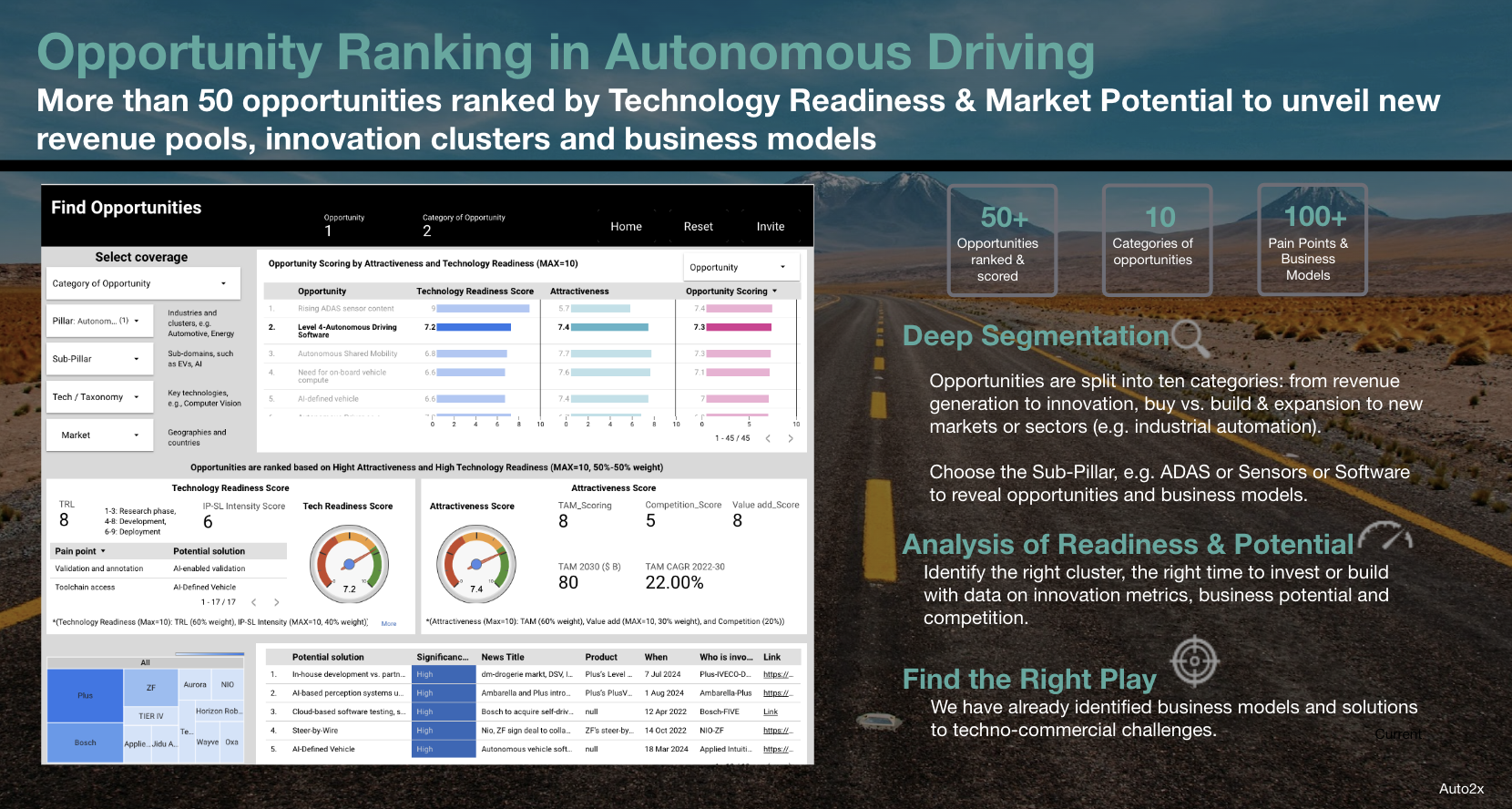

- Live Ranking of Top-100 Opportunities in Autonomous Driving

- Innovation Roadmaps in +30 key AD technologies

- Player Readiness Scores and Competitor analysis

- Live Start-up Database

- Top Innovation Hubs

- Interviews with CXOs

- Continuous data updates through our innovative automated intelligence technology.

- Our report is designed for unlimited access, allowing you to share it freely among your team without any user restrictions

Key questions this report answers

- What are the most promising opportunities in autonomous vehicles based on market potential and technology readiness?

- Which car markets are leading the race to full autonomy? What is the outlook?

- What are the roadmaps of carmakers in ADAS? What is their Strategy, Technology & Market Readiness?

- Which suppliers hold the largest market shares and have the most advanced Autonomous Vehicles Technology?

- Which start-ups have the biggest potential to solve key challenges in the digital transition, disrupt Autonomous Mobility and bring new value to customers?

Who Should Read the Autonomous Vehicle Market Report

- Competitor Analysis, Market Intelligence and Strategy functions in global OEMs, Tier-1/2 automotive suppliers

- Innovation teams and R&D

- Engineering teams

- Investors and investment professionals

- Software development professionals

- Regulators, policy-makers and other stakeholders

Table of Contents

- The Opportunity in Autonomous Vehicles

- Rising ADAS Sensor Content

- Need for on-board vehicle compute

- New Features, SOTA updates & FoD

- ADAS HMI & opportunities in health

- Opportunities from Software-Defined Vehicles

- Metaverse & WEB3 opportunities

- Connected Road Infrastructure

- Regulation for L3-4 AD, Cyber & AI

- Deployment & Emerging Markets

- Collaborations and Level 3-4 Platforms

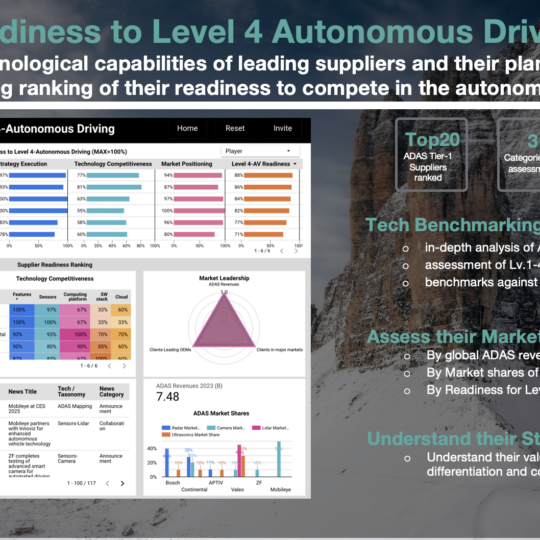

- ADAS Supplier Rankings in Autonomous Vehicles

- Trends in Supplier ADAS-AD Strategy

- R&D of Suppliers in 2023 to drive AD-SW

- New Product Launches in Jan-Sep 2024

- Key collaborations in Jan-July 2024

- Technology Competitiveness ranking

- Sensor portfolio of Tier-1 Suppliers

- Radar and Camera benchmarking

- Revenues by ADAS-Software divisions

- Rankings by ADAS Revenues

- Supplier market shares in 77GHz radar

- Alibaba

- APTIV

- Amazon

- Bosch

- Baidu

- Continental

- Denso

- Hella

- Hitach AS

- Hyundai Mobis

- Huawei

- Lenovo

- Magna

- Mando HL

- Microsoft

- Intel-Mobileye

- NVIDIA

- Qualcomm

- Samsung-Harman

- Valeo

- Veoneer

- Zenseact

- ZF

- Carmaker Roadmaps to Autonomous Driving

- Approaches to Lv.4

- Trends & AD Status

- OEM AD Roadmap

- Generative AI & ML in Autonomy

- Autonomous Driving Perception Software

- Audi (VW Group)

- BAIC

- BYD

- Chery

- BMW’s Level 3 plans

- Ford Level 2 BlueCruise

- General Motors

- Geely

- Great Wall Motor

- Honda

- Hyundai

- JIDU Auto

- KIA

- Lotus

- Mercedes-Benz

- Nissan

- NIO

- Tesla

- Renault

- Stellantis

- Toyota

- Volvo

- VW

- XPENG

- Start-up | CEO Talks

- Trends in Automotive Start-up Funding

- AI Start-up funding

- CXO Talks

Carmakers Roadmaps from Levels 2-4

Carmaker have big plans for autonomous vehicles, but deployment strategies face delays

Carmakers have unveiled their vision for Fully-Automated driving but vehicles are mostly fitted with AD technology is still “highly-assistive”. Deployment in private cars follows a different roadmap to autonomous trucks and shared mobility (robo-taxis) due to the following reasons.

- Engineering challenges to reach higher levels of autonomy, such as requirements for sensors, e.g. form and fitment factor for series production;

- Regulation: Level 4 is not allowed for private cars,

- Commercial challenges, such as consumer adoption and pricing strategies (e.g. subscriptions).

Level 4-Autonomous Valet Parking has high technology readiness and an easier path to regulatory approval

Mercedes-Benz and Bosch have conducted pilots of L4 Automated Valet Parking, but it’s still not legal and requires additional approvals.

Baidu’s Level 4 Apollo Self Drive features in JIDU Auto’s Robocar 07

In September 2024, JIDU announced the upgrade from PPA intelligent driving to ASD (Apollo Self Driving), the Level 4-AD large-scale model.

JIDU Auto, a Joint Venture between Baidu and Geely, is the first brand to adopt Baidu Apollo ADS, which combines pure vision with an end-to-end large-scale model to support fully unmanned Level 4-Autonomous Driving tailored to Chinese roads.

The company claims this is the only system in China and one of only two globally vision-based Level 4-capable systems, together with Tesla.

However, the company believes its system is more powerful in China because of training in domestic roads and its 2-stage, end-to-end large model approach vs. Tesla FSD’s 1-stage.

Fragmented deployment of Level 3-Autonomous Vehicles is coming to the US and Germany in 2024

The update of UNECE Regulation No.79-Steering equipment to Regulation No 157-ALKS (Automated Lane Keep Systems) allows Level-3 Conditional Automation up to 130 km/h on highways. UNECE signatories, such as Japan, Germany and the UK have ratified the regulation making the deployment of Level 3 legal.

Honda and Nissan launched Lv.3 in Japan in 2021 leveraging the update of the UNECE regulation.

Honda’s Legend with Level 3 system called “Sensing Elite” went for sale in March 2021.

Changan has Level 3 in China.

Tesla has the technical capability of Level 3+ in the U.S., with an FSD update coming in 2025.

BMW and Mercedes-Benz have approvals to launch Level 3 in Germany and the US.

Lidar fitment strategies vary across brands for Level 3 systems

Lidar fitment strategies for Level 3-Conditional Automation vary. BMW (iX & 7-Series) and Mercedes-Benz (L3-Drive Pilot) are equipping their new cars with Lidar for Lv.3+/4.

Launches of Level 2-Partial autonomous vehicles proliferate

New launches of Level 2+ systems equipped with Level 3/4 Hardware, such as lidar and computing proliferate in China and Europe.

Chinese carmakers are following this strategy to overcome the challenges of regulatory approvals for Level 3 and update their systems to Level 3 with over-the-air-updates when they are legal.

Level 2-Driving features progress from low-speed, single-lane Traffic Jam Assist (TJA) to higher speed, multi-lane Cruise Assist (CA) capable of changing lanes.

Tesla, Ford, NIO explore monthly / annual ADAS Subscriptions

Tesla, Ford, NIO are among the automakers who leverage their Over-the-Air update capabilities to offer monthly and annual subscriptions for their ADAS. This gives the opportunity to owners to test the features at a more affordable entry price point, or even after they have purchased the vehicle.

- Tesla FSD is $99/month in the U.S

- Ford Motor Company BlueCruise Level 2 at $55/month.

- NIO charges about $55 a month for its driver-assist features

Autonomous Trucks move from pilots to deployment

There are several OEMs and start-ups working on Autonomous Trucks, such as Aurora with plans to commercialise them by 2027, Continental, Daimler Trucks, Einride, Fernride, Gatik, Inceptio Technology, Isuzu, Kodial Robotics, Oxa, Plus, StackAV, Scania (Traton), Waabi, and Waymo.

The Autonomous Trucks market is consolidating

However, the market is consolidating. Waymo’s decision to shift away from autonomous trucking, the failure of Embark Trucks and its sale in May and TuSimple’s decision to seek a possible sale of its U.S. operations show consolidation in Autonomous Trucking market.

GenAI to Bridge the Technological Gap to Level 4 Autonomy

Waabi’s Copilot4D: A Foundation Model for Autonomous Trucks

In March 2024, Waabi introduced its Copilot4D: A Foundation Model for Self-Driving. The integration of generative AI into Copilot4D enables it to learn from vast amounts of sensor data without requiring extensive human supervision. This is pivotal for scaling autonomous driving technologies effectively and safely.

Copilot4D, the first foundation model that explicitly reasons in 3D space and the fourth dimension, time, learning remarkable capabilities for interacting and acting in a dynamic world, whether in simulation, like Waabi World, or in the physical world we live in. Waabi

It allows them to predict future scenarios based on real-time data from LiDAR sensors. The model enhances decision-making processes by allowing vehicles to foresee how other road users will behave, thus making proactive rather than reactive decisions.

Autonomous Mining, deliveries and logistics have high market potential and market readiness

In June 2024, Scania opened orders for its autonomous tipper truck developed in close collaboration with customers in the mining industry.

In September 2024, Oxa acquired StreetDrone to advance industrial logistics.

Robotaxis Are Expanding Across Geographies and Sectors

Geo-fenced Level 4-Fully Automation was launched in 2019 by Waymo’s Waymo One robo-taxis (or Automated-Mobility-on-Demand, AMOD).

Waymo, WeRide, Baidu are expanding the operation of their robo-taxis and robo-shuttles from the US and China to Singapore, UAE, Europe and Israel.

At the same time, Autonomous Mobility players are exploring new sectors, such as WePilot expanding into unmanned sanitation machines. Other players are expanding into autonomous delivery bots and logistics.

ADAS & Autonomous Driving Suppliers

How ADAS Suppliers benefit from the rising sensor content in vehicles

Automated Driving revenue will grow from €19.3 Billion in 2020 to €35 Billion in 2025, finds Auto2x

ADAS sensors, such as radar, camera and ultrasonics, and ADAS features account for the majority of Automated Mobility’s revenues today for carmakers, suppliers, and other stakeholders.

The rising ADAS content in vehicles, such as cameras, Lidar, computing and software to support Level 3-4 Automated Driving will lead to more revenues for Automotive Suppliers.

- By 2030, 67% of vehicles sold globally will have at least Level 2 and 3 autonomous driving capability. We expect only 25% of these vehicles to have Level 4 and under 5% to have Level 5 full automation capabilities.

- ADAS Average Content per Vehicle in 2020 ranged from €489 for Level 2 with 17 sensors per car, to €960-€2.100 for Level 3, depending on the usage of lidar for redundancy.

- Lidar, supercomputers and Automated Driving-Domain Controllers to support Lv.3-4 Automated Driving will also become a substantial revenue pool.

Suppliers’ Opportunity in the Rise of On-board High-Performance Computing

The computing power required to shift from Level 2 to Level 5 increases exponentially.

- Lv.2 vehicle is 10 TOPS (trillion operations per second.

- Lv.4 exceeds 100 TOPS,

- Lv.5 vehicle will require a 1,000 TOPS computing processing power.

NVIDIA is a strong player in AI-vehicle brain by supplying their AI-computer to many Chinese brands, such as BYD, Hyper, Li Auto, Nuro, XPeng, Zeekr, and other carmakers such as Volvo (Geely). NVIDIA is also supplying autonomous trucking companies, such as Waabi and robo-taxi / robo-shuttle providers such as WeRide.

Other suppliers in the Autonomous Driving-Domain Controller (AD-DC) space include:

- APTIV: with their AS-DC integrated by BMW

- Continental’s Cross-Domain (HPC) High-Performance Computer

- Lenovo, who entered the ADAS-DC market as a Tier-1 supplier and partners with NVIDIA;

- Valeo with an ADAS-DC capable of 100- to 500 TOPS

Which suppliers are better prepared for the new era of Autonomous Mobility?

Which automotive suppliers are leading the race to Autonomous Vehicles? Read the dedicated report here.

Let’s start with the basics, the ranking by Automotive Revenue. Auto2x examined the revenues of the 15 biggest Automotive suppliers to derive the rankings by revenue. We excluded Non-Automotive revenue which includes Industrial, Consumer Goods, Energy and Building business units and more. We also focused on those suppliers with offerings in ADAS and Autonomous Driving.

The Top-15 Suppliers recorded €360 Billion in Automotive revenue in 2023, found Auto2x

Bosch remains 1st supplier with €56 Billion, followed by ZF. Hyundai Mobis capitalized on its growth and the slowdown of Denso and Continental. Out of the 15 Suppliers examined, 13 increased their Automotive Revenues in 2023, except for Denso and Panasonic. Mitsubishi Electric recorded the strongest growth followed by Hyundai Mobis, APTIV and Forvia with 14% y-y.

Could new entrants disrupt major ADAS Suppliers?

Traditional ADAS suppliers still maintain the lion’s share in automotive. But they face competition from US, Chinese and other Tech giants who are capitalizing on their expertise in AI, Cloud and Software transforming automotive.

We have identified a number of opportunities for Tech Companies to enter or disrupt the existing supply chain in autonomous vehicles.

- Next-gen Perception Hardware for Autonomous Driving:

- Computing, e.g. for Peta-ops chips for Autonomous Driving

- AI: AI for Autonomy and HMI such as in-car AI assistants

- Data-based Mobility Business models such as in-car e-commerce

- 5G-6G, Connected Infrastructure and Smart Cities

- Autonomous Shared Mobility: AMoD, autonomous deliveries

Baidu and INTEL lead the overall competitiveness, followed by Amazon.

- INTEL’s Mobileye spearheads its Autonomous Driving strategy and has captured a large share in ADAS helping INTEL score higher than Baidu in Strategy Execution;

- Baidu offers competitive technology offering today due to Apollo’s strengths

Autonomous Driving Start-ups

Funding Trends

Early-stage funding in Automotive start-ups, which includes Pre-Seed, Seed, A and B Series, amounted to $24 Billion between 2021 & Q1 2023.

Electric vehicles ($12B), Mobility business models ($6B) and autonomous vehicles ($6B) accounted for most of the funding. Funding in Web3, which supports decentralization, privacy and transparency, rose from $29M in 2021 to $36M in 2022.

Funding rebounded in 2023 to $2.6 Billion, from $1.9 Billion in 2022, but it’s still below 2021 ($3.6B).

Autonomous Driving Software, next-generation sensors and computing are in demand, with tele-operation emerging

The 10 most notable funding rounds in Autonomous Vehicles came from the following entities:

- Wayve ($1 Billion in Q2 2024) to advance Embodied AI

- Aurora ($820M, who is working with Continental on Autonomous Trucks)

- Deeproute ($300M, L4 Autonomous Driving for Robotaxis and Trucks),

- Didi Woya ($300M, L4 Autonomous Driving Robotaxis)

- WeRide (300M, L4 Autonomous Driving Robotaxis)

China leads funding with $12.9 Billion raised from 120 start-ups. European start-ups raised $3.2B, of which $1.0B went to Electric Vehicles and $0.7B for Autonomous Vehicles.

Listen to the interviews with buzzing start-ups Recogni, PreAct Technologies and Actify

We sat down with R K Anand, Founder & Chief Product Officer, Recogni to discuss:

- Why computing is a key enabler for safer ADAS, as well as higher autonomy;

- Recogni’s advantages in high-performance, low-power consumption computational platforms for perception processing;

- How product fit and customer acquisition matter for Recogni’s growth strategy

- Recogni’s success story, milestones, and growth velocity

Paul Drysch, Founder & CEO, PreAct Technologies

PreAct’s market, near-field sensing, is already a $30 billion-a-year market. However existing technologies are holding back the industry from reaching self-driving functionality. We want to replace other sensors with our short-range lidar that could enable better functionality and convenience at the same cost”,

Dave Opsahl, CEO Actify

- The need for digitalization of Program Management in the automotive industry to support the complexity and scalability of vehicle and parts manufacturing

- How Actify’s software management & UX can help to overcome resource constraints & support the fast transition to electrified mobility & networked driving

- Actify’s go-to-market strategy, product-fit benefits and availability of solutions

Big Opportunities Fueling Competition in Autonomous Vehicles

Next-generation sensors for Autonomous Vehicles

Improvements in radars

- Higher longitudinal and lateral resolution (Imaging radar)

- Better vertical Field of View allows better discrimination of relevant static objects

- Better object classification (better resolution and processing)

Advancements in new camera/vision technology for autonomous vehicles

- Better range and object detection capabilities (better resolution sensors)

- Better availability (sensors with better dynamic range)

- Higher coverage (different Field of View optics)

- Moving to satellite cameras – processing in a central computing platform

Lidar innovation focuses on better detection and improved packaging

- Ability to detect smaller objects (better resolution)

- improved package (size, weight – moving to solid state lidars)

- Improved range and field of view

Opportunities in Generative AI for Autonomy

Simulation for safety in autonomous vehicles: Generative AI and neural rendering could revolutionise simulation for AVs. Researchers and Developers are harnessing foundation models, such as vision language models, to generate complex scenarios aimed at stress-testing vehicles. By utilizing Generative AI for simulation of scenarios and “edge cases”, developers could improve the efficiency and performance of autonomous driving software. However, the regulatory landscape is not ready to provide clarity and requirements for robustness.

LLMs and large-scale models for Level 4-Autonomous Driving: JIDU Auto is the first brand to adopt Baidu Apollo ADS, which combines pure vision with an end-to-end large-scale model to support fully unmanned Level 4-Autonomous Driving tailored to Chinese roads

In-vehicle usage: Faraday Future’s FF 91 will feature the brand’s Generative AI Product Stack. Use cases include entertainment and social media. But, data quality, ethical guidelines and privacy policies are needed to filter out offensive or intrusive content.

Personalized Mobility: by personalizing the passenger’s journey or traffic optimization. One of the main concerns is cyber security for these applications related to Intelligent Transportation Systems.

New opportunities in Software-Defined Vehicles

What are some key new Software-driven features with high potential?

Software represented around 10% of overall vehicle content in 2018 for a D-segment car ($1,220) & it will grow with CAGR 11% to reach 30% ($5,200) in 2030. Major Tier-1 Suppliers are already monetizing the growth in ADAS Sensor content.

In the 2020s, the vehicle’s software value will exceed that of hardware as carmakers shift to more common platforms to achieve cost savings. What’s more, the software will be crucial for product differentiation such as new features, content, and new personalized experiences.

The shift of value to software will shape a new Software-based revenue model for Automated Mobility as existing players are forced to shift away from vertically integrated, asset-heavy business models to compete with new entrants. The economics of software are a strong fit for volume OEMs.

Software is the answer to the Digitization of the Automotive Industry but delivery is challenging.

Learn about top innovation clusters across major technological building blocks of SDVs:

- EE Architectures: Assess the roadmaps of leading carmakers and suppliers in the development of centralized architectures and their partnerships;

- CarOS: Learn about the rising adoption of Google’s Android Automotive OS and the competitive offerings from MBUX and other players;

- Open-source software development

- Cloud: the emergence of automotive cloud as an enabler for cloud-based ADAS development, development of offerings from carmakers and the role of Microsoft, Amazon among others;

- Over-the-Air-updates and the opportunities for features-on-demand;

- Digital Twin

Software that facilitate data interoperability and speed-up development of Connected Car Services could unlock another +$70 Billion by 2030

Cars are becoming increasingly connected with each other, the road infrastructure, our homes, and more, due to the rising penetration of embedded, tethered or integrated connectivity.

By 2030, more than 80% of cars will be Connected, with a service value of more than $100 per vehicle.

But the Connected Car Services market is fragmented today, among other inefficiencies.

The integration of new services from providers of vehicle maintenance, parking, insurance, fleet management, analytics or other use cases, is costly and difficult.

What’s more, the development of apps for in-vehicle infotainment faces challenges of scalability.

Rising Autonomous Vehicle Hubs

3 reasons why China can win the Autonomous Vehicles race

How do regulation, innovation and consumer demand affect the adoption of autonomous vehicles?

Auto2x assesses that China will take over global leadership in Level 2-Autonomous Driving in 2025 with 1.70 million cars equipped with Traffic Jam Assist and Cruise Assist, ahead of Europe and the USA.

China benefits from the fast go-to-market strategy for advancements in Automated Driving technology, strong digital infrastructure, favourable regulation and positive consumer sentiment.